It could seem conflicting, but making all your buys with credit cards can be a much more successful budgeting method than the old-fashioned cash method.

Once you think of budgeting, you'll envision apportioning cash in independently labeled envelopes or making complicated spreadsheets with different colors and fonts.

Budgeting can cruel those things — but did you know that

credit cards can be one of the foremost powerful budgeting devices? It sounds outlandish since unsecured credit lines can as well effectively entice many cardholders to overspend instead of spare. But in case you've got the teach, they’re an fabulous budgeting resource.

On the off chance that you suspect you're an enthusiastic high-roller, it’ll without a doubt behoove you to remain absent from

credit cards until you’ve prevailed that angle of your financial propensities. “Good” sorts of obligation exist (like contracts and auto advances), but

credit card obligation isn’t one of them.

But on the off chance that you’ve got the budgetary development, take after these standards to budget with

credit cards successfully.

Whether you’re purposely budgeting with a

credit card or not, the key to

credit card victory is to treat them like cash. After you buy something, pay it off (nearly) immediately.

You don’t got to wait until you get your month to month

credit card charge to create installments. Numerous of us, counting me, make numerous installments amid a charging cycle instead of one month to month protuberance installment. It’s superfluous (unless you’re making enormous buys), but it’s a mental move I utilize to assist me think of my lines of credit as cash — not fair free money.

I observe my month to month net salary wane with each

credit card installment, and it keeps me on track. Additionally, you’ll never have to be stress almost being dinged with a late fee.

Numerous

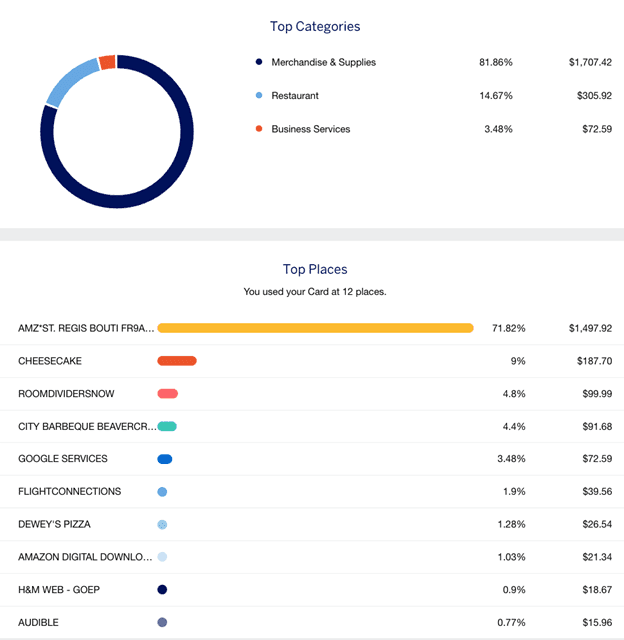

credit card backers (like Chase and Amex) perfectly track your investing and make it simple for you to see

at a look how much you’ve went through in each category each month. It’ll appear you what you’ve exhausted for travel, eating, stock, commerce administrations, etc.

Usually colossal for tireless budget-keepers. You ought to reference this exceptionally edible (and beautiful) device against the limits you’ve set yourself. In case you’re a couple of days into the month and you’ve as of now went through an excessive sum on excitement, you'll spot the drift immediately.

Note that this data’s default will likely show your investing since your final charging cycle. In case you’re inquisitive about month-to-month, or maybe paycheck-to-paycheck, you’ll got to physically alter the date ranges you’d like to view.

Guarantors moreover regularly permit you to set cautions for your

credit card investing propensities. For illustration, Amex gives you the choice to get an caution once you spend a certain sum amid a charging cycle or make a buy over a indicated sum. You'll moreover get a week by week preview of your account spending.

I right now have eight

credit cards. Six are individual cards, and two are little trade

credit cards. I like to keep my individual and trade investing partitioned — and utilizing little trade cards makes a difference colossally when budgeting for month to month expenses.

Whether you’re in a comparative circumstance or essentially discover it accommodating to put certain costs on distinctive cards, this may be another way to implement your budget and categorize your cash stream. For case, you'll have a

credit card committed to:

- Grocery stores.

- Monthly utilities.

- Gas stations.

- Everything else

Once you log into your gas station card’s online account, you’ll rapidly see how much you’ve went through on gas for the month. No other buys have posted to that account — and on the off chance that they have, they’re either false, or you’ve been impulse-spending.

This will be a way to clear the clamor from a single card with a list of exchanges a mile long. On the off chance that you’re over budget this month, you’ll discover the issue on your “everything else” card.

Numerous cards offer the advantage of free authorized clients — or within the case of little commerce cards, free representative credit cards. The enchantment budgeting trap here is that a few banks (like American Express) permit you to set investing limits one of a kind to authorized user/employee cards.

You may essentially include companions or family individuals to your card and keep them yourself. Include as many authorized users as you have got investing categories, and set each constrain in like manner. American Express permits you to lower each investing constrain to $200.

One of the benefits of budgeting with cash is that you just are constrained to remain inside your implies — or you’ll basically run out of money. The peril of

credit cards is simply can impulse-shop your way into five paychecks from presently in the event that you’re not vigilant.

Whereas not a immaculate arrange of assault, you'll be able still imitate a cash-based budget with a

credit card. I’ve done this myself some time recently, and it truly can be helpful.

Parcels of shippers offer Visa blessing cards which can be utilized anyplace Visa is acknowledged. At basic supply stores, you'll be able regularly purchase them in variable increases up to $500. On the off chance that you’ve built up a budget of $200 per month for feasting out, you'll be able buy a $200 blessing card and mark it as “restaurants.” On the off chance that your month to month budget for amusement is $150, you'll purchase a $150 blessing card and stamp it “entertainment.”

In any category for which you need to guarantee you don’t overspend, you'll be able purchase a Visa blessing card for that correct sum. When the blessing card runs out, you’re done until following month.

In case this technique requests to you, consider the reward categories of whichever

credit card you arrange to utilize; you will be able to win reward rewards on your blessing card by thoughtfully obtaining your blessing card from certain stores. For example:

- In case you've got the Amex Gold Card, you'll purchase your blessing cards from a general store. This card gains 4 Amex Enrollment Rewards per dollar on up to $25,000 in buys at U.S. grocery stores per calendar year (at that point 1 point per dollar).

- On the off chance that you've got the Ink Trade Cash® Credit Card, you'll buy your blessing cards from Staples. This card wins 5% back on the primary $25,000 you make in combined buys each account commemoration year at office supply stores and on web, cable, and phone services.

The most destruction of this procedure is that blessing cards ordinarily come with an actuation charge of $5 or more. On the off chance that you’re not willing to eat $5 (it can include up rapidly on the off chance that you’re buying numerous blessing cards), hold up for the irregular store advancements that forgo this fee.

A modest bunch of costs basically cannot be made with a credit card. For illustration, most moneylenders will not allow an auto advance or contract to be paid with a credit card. In any case, in case it makes a difference your budgeting to run all installments through your credit card, there are loopholes:

- Plastiq may be a benefit that charges a expense (2.85% at the time of composing) to pay almost anything with a credit card — counting contracts and car installments. Utilize your credit card to pay Plastiq, and they’ll cut a check to about any biller or dealer for you. There are a few card issuer-specific limitations, so explore in the event that this interface you.

- The no yearly charge Bilt Mastercard® is the as it were credit card on the showcase that permits you to pay lease for zero expenses. You’ll indeed gain one Remunerate per dollar on up to $50,000 in lease each year. Note simply must make at slightest five buys per charging cycle to gain rewards.

With these administrations, you'll be able pay your greatest month to month bills whereas still utilizing your credit cards as budgeting tools.

Entirely utilizing cash is the old-school — and secure — way to budget. In the event that you don’t utilize credit, you won’t discover yourself in obligation, and you won’t be subject to nightmarish intrigued charges.

But the issue with this strategy is that you simply won’t reinforce your credit history or win important credit card rewards by budgeting this way. In the event that you know a number of traps, budgeting with credit cards can be inconceivably viable, not to say simple. Fair be beyond any doubt to budget for credit card yearly expenses in case you arrange to utilize cards that cause them.

Read Article:

The rise of the crypto cop

Kevin Rose on crypto winters, pseudonymous authors and his buzzy Moonbirds NFT extend

Tips to Make Your Diet Healthier

List of Healthy Foods To Eat

How entertainment affects our lives

.jpg)

.jpg)

Comments

Post a Comment